Praxis epilepsy drugs will work but essential tremor drug will not

And that's ok, there is much upside to be realized on executing well with epilepsy drugs

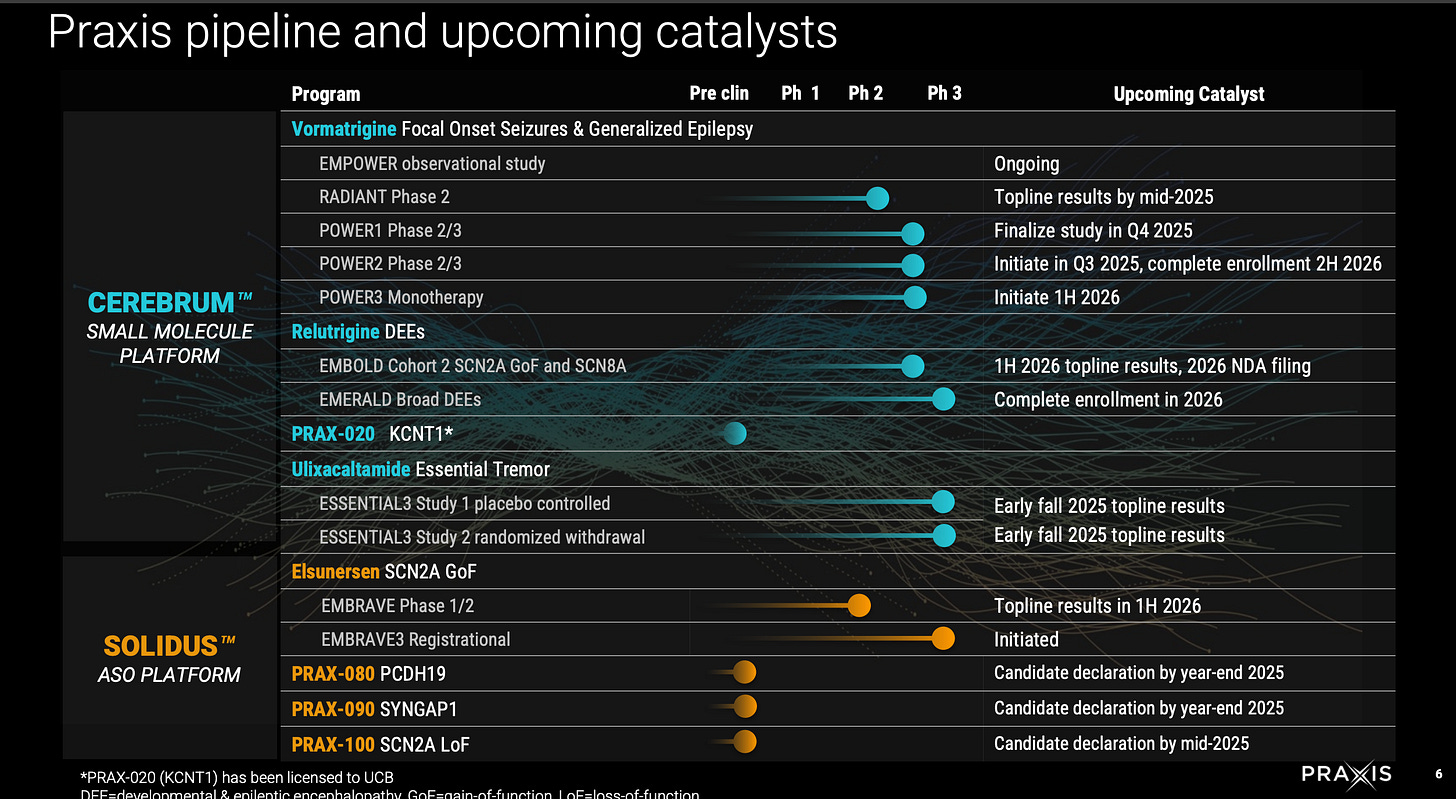

Key catalysts:

ESSENTIAL3 Ph3 trial of Ulixacaltamide in Essential Tremor (Q3 2025)

New ASO drug candidates 2025. (PCDH19, SYNGAP1, SCN2A LoF)

POWER1 complete 2H 2025, readout 2-3 months later

EMBOLD2 (1H 2026)

EMBRAVE (ASO for SCN2A) Topline 1H 2026

EMERALD broad DEE (enrollment done 2026)

The three bolded events are the ones that matter most.

We’ll walk through each of these events.

Essential3 (Ph3) trial of ulixacaltamide (UX) in Essential Tremor

If Essential3 results are good, UX becomes a new treatment for essential tremor. There are 5-10 million patients with essential tremor of which 30-50% are typically treatment-refractory. Current standard of care is primadone and propanalol both priced on the order of $10/month. That’s why it makes sense for UX to be priced a little higher but also as a second-line or refractory treatment option for patients whose conditions are not improved significantly on the cheaper first line therapies. So, conservatively, that’s 1.5M (0.3 x 5M) total patients ulixacaltamide can be useful for. At $100/month at 50% of 1.5M patients, peak yearly sales is 900M.

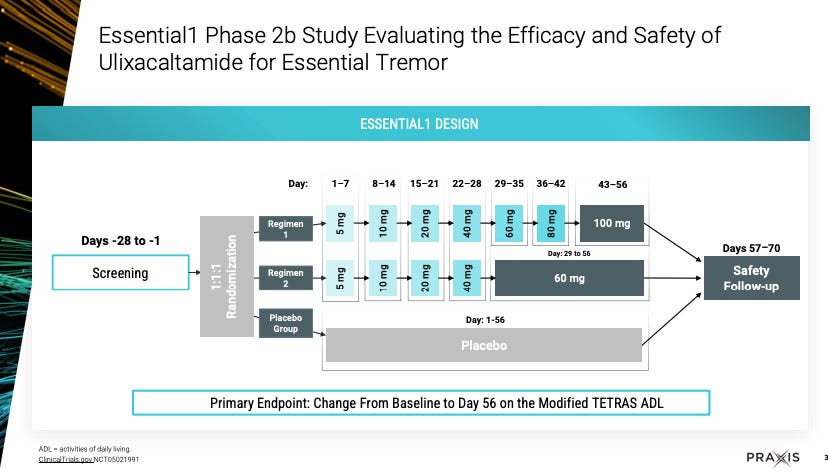

The story with UX has been one of not statistically significant endpoints, discussion with FDA on endpoint measurement, and delays in reporting results. In March 2023, Essential1 results were presented.

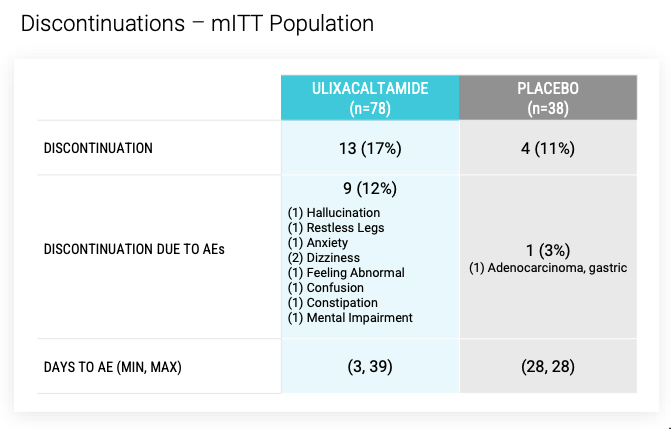

Enrolled patients could continue propanolol at stable dose during trial, and could not have had prior surgical treatment or focused ultrasound treatment for ET. Per ITT, 78 patients on UX (13 d/c - AEs for 9, withdrew consent 2, lack of efficacy 2) and 38 on placebo (4 d/c).

Primary endpoint was baseline to day 56 mADL score measured as such:

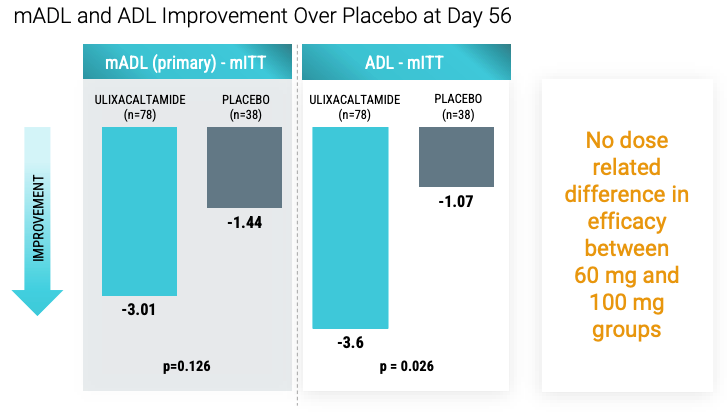

mADL had p=0.126 and per Praxis, no dose related difference in efficacy between 60 and 100 mg. Roughly 38 patients in UX 60 mg and 38 in UX 100 mg so if efficacy difference not seen its probably real given sample size is decent. The interesting part is that UX was uptitrated in dose from 5 to 60/100 depending on treatment arm protocol which led to patients receiving only 1 month of treatment before mADL measurement.

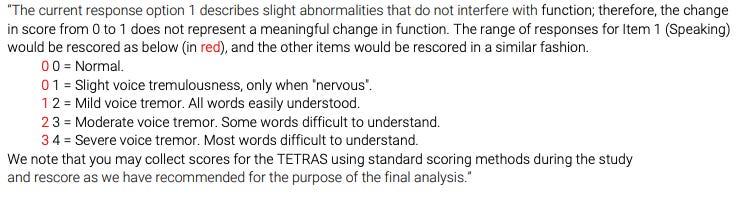

After these results, Praxis discussed with FDA on endpoints and the following was recommended: TETRAS-ADL can be used as an acceptable endpoint. But, exclude item 12. And rescore accordingly:

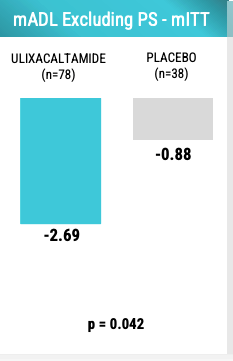

Basically, FDA is saying use mADL but get rid of PS6 and 7. Here are the results:

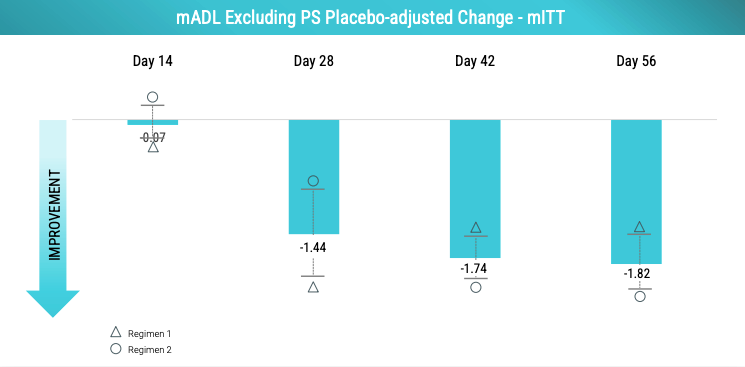

Looks better. And, there is some deepening of response over time but interestingly the response does not appear dose-dependent. Note that Day 28-56 is when patients got at least 60 mg of UX in Regimen 1 (up to 100 mg) and Regimen 2 (max 60 mg).

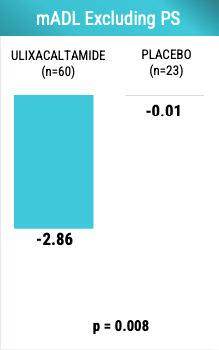

The dose-clinical efficacy relationship of UX appears to be sigmoidal with the point of plateau being at least 60 mg if not earlier. Praxis learned that they need to control for the presence of ET patients with intention tremor given that patients with intention tremor may not respond well to UX. Below is the mADL changes in patients without intention tremor. Note that UX effect size is larger than the -2.69 observed when including all patients.

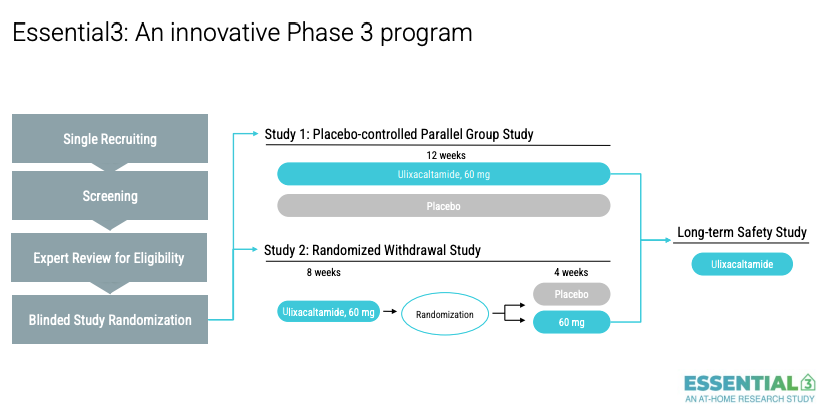

So that was March 2023. They initiated Essential3 that has 2 studies. Originally Praxis messaging was that the UX 60mg arm would be treated for 6 weeks but as we see here from their Aug 2025 slide deck, they extended it to 12 weeks.

In February 2025, Praxis reported “Based on the predefined decision framework for Study 1, the [data monitoring committee] has recommended that the study be stopped for futility, due to the results being unlikely to meet the primary efficacy endpoint under the parameters set by the statistical model. The committee also indicated that some underlying assumptions of the statistical model might have influenced this outcome and encouraged Praxis to explore alternative analysis methods”. The primary endpoint was the mADL11 that they reported statistically significant results for in Essential1. Further, “Given the advanced state of enrollment for both Study 1 and Study 2 in the Essential3 program, and in the context of the advice received by the IDMC, Praxis has decided to continue both studies to completion, with topline results expected in the third quarter of 2025. The decision about whether the data supports the submission of an NDA will be made after analyzing the final results for Study 1 and Study 2”. Their CEO said “We are disappointed with and surprised by the outcome of the interim analysis for Study 1. Following the advice of the committee, we will explore different analysis methods for the final dataset, which is expected in the third quarter of 2025”.

Almost surely, the results of this trial will NOT be good. The stock dropped ~55% on the day these comments were released. Since then the stock has hovered around this. I think the market has priced in this failure.

RARE scenario. I don’t see this happening but just wanted to lay it out. If UX has minor AEs for the most part (as we saw in Essential1) and given the current FDA’s wantingness to allow for patient choice in diseases with high unmet need, there is a world in which UX can be approved for treatment-refractory essential tremor. Patients with severe treatment-refractory essential tremor are affected by their tremor in all parts of their lives and would likely be willing to try a relatively safe new drug if it could help them do some of their acts of daily living (ADL) more independently. It says something that Praxis has 200k+ people with Essential Tremor that expressed interest in joining the study.

Some new drug candidates to be announced in 2025 year end for PCDH19, SYNGAP1, and SCN2A LoF disease. All ultra-rare diseases. No other comments here. Will need to initiate trials after announcement. Will take 2-3 years to get to approval probably.

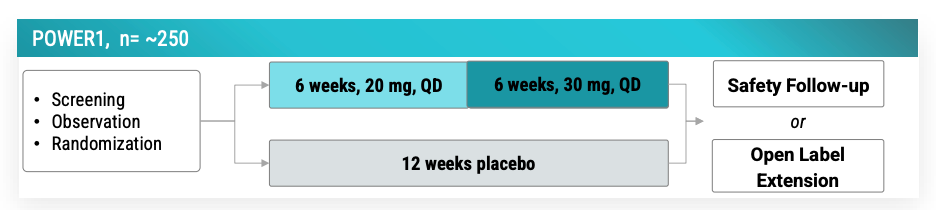

POWER1 (n=250) expected to complete 11/2025 and study completion 12/2025 per clinicaltrials.gov and company guidance of 2H 2025. Readout to be expected 1H 2026 by March. POWER1 is the placebo-controlled version of the open-label no-placebo RADIANT (n=37) trial that reported vormatrigine in focal onset seizures.

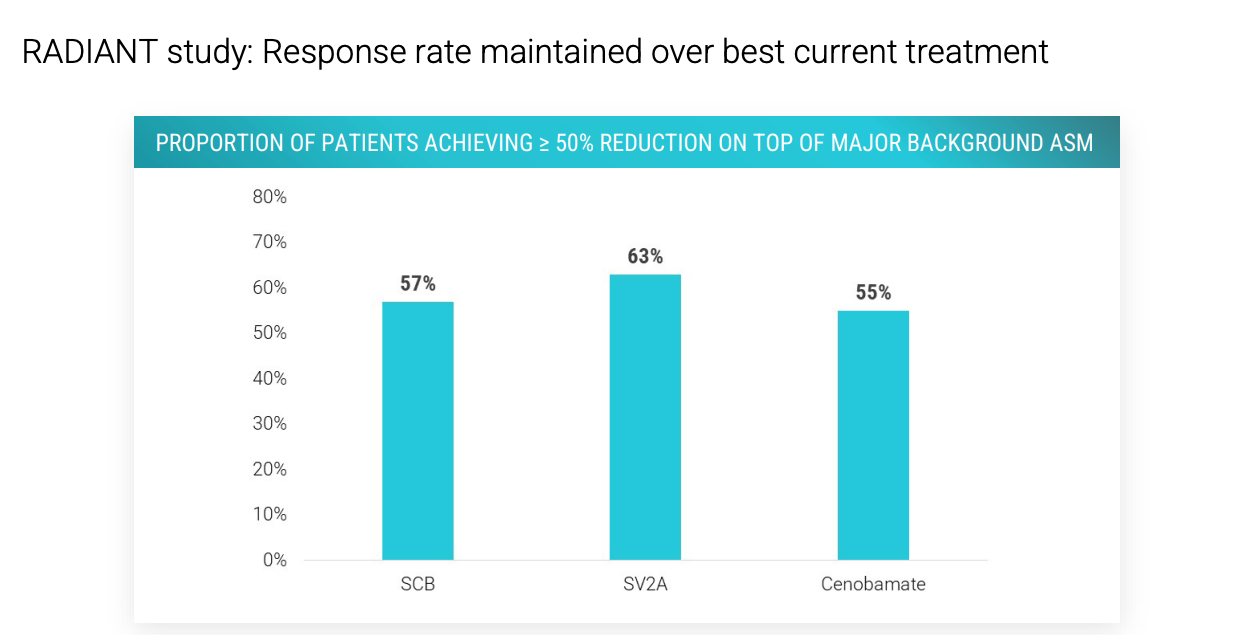

56.3% overall median seizure reduction at 8 weeks, and 60% of patients with over 50% seizure frequency reduction. 22% of patients seizure free in past 28 days. 56% with >12 seizures / month achieved 50+% reduction.

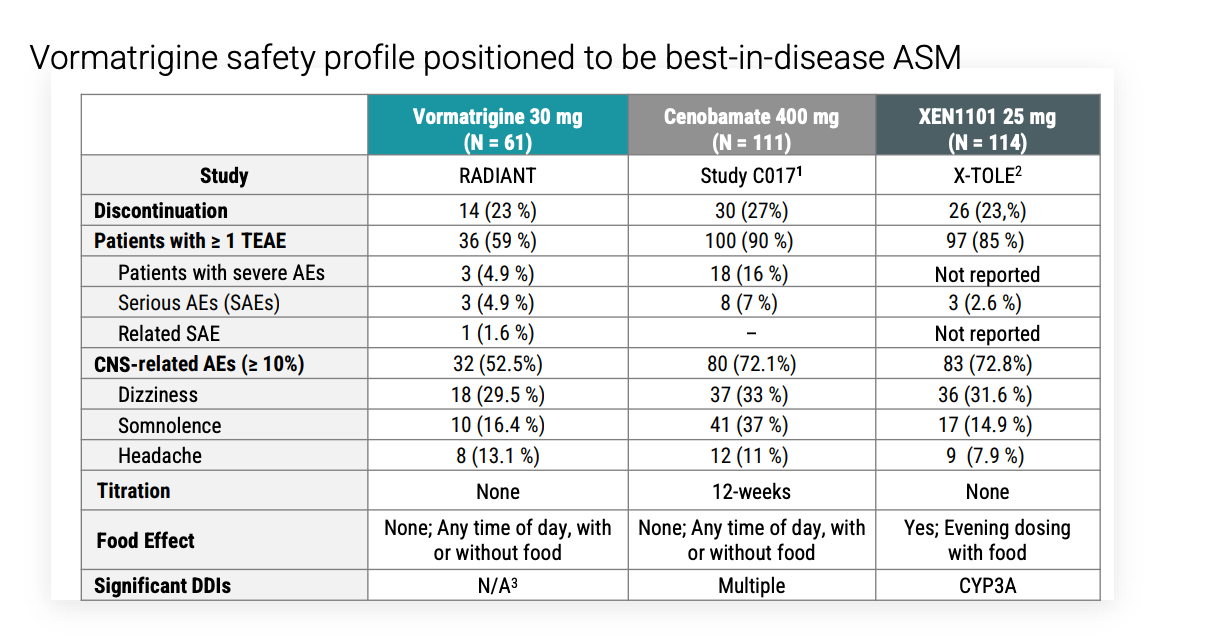

Safety profile fairly low, although with a decent discontinuation rate.

Investigators had the option to reduce the dose of the background medication to manage AEs and when this was done instead of d/c vormatrigine, 6/6 patients stayed on study. They know to advise investigators to do this and to counsel on what AEs to expect. Serious AE rate was 4.9% compared to 2.6% of XEN1101. What were these AEs?

The main comparison for vormatrigine is XEN1101 (aka azetukalner). XEN1101 Ph2b results were reported in JAMA neurology in Nov 2023. Since then, 2 Phase3 trials (X-TOLE2, X-TOLE3) are underway for focal onset seizures (enrolling 360 patients each). After completion of one of these trials, Xenon plans to submit NDA to FDA. In Oct 2024, Xenon announced it anticipated completion of patient enrollment in X-TOLE2 by end of 2024. The treatment period is only 12 weeks so results should have been reported by Q2 2025 at the latest. Now on clinicaltrials.gov, they are expected to complete 2026 and are still recruiting. Company guidance says to expect topline results early 2026.

Key differences: Xenon1101 was given with food, Vormatrigine is not. 25 mg XEN1101 had ~55% of patients have >50% seizure reduction. Vormat had 60%. Both were treated for 8 weeks.

Notably: XEN1101 is primarily metabolized by cytochrome P450 3A4 isozyme (CYP3A4) without substantial involvement of other CYPs, and plasma levels of XEN1101 may decrease in the presence of CYP3A4 inducers. Vormatrigine does not have this problem. CYP3A4 is inhibited by antifungals, some antibiotics, non-DHP CCBs (verapamil, dilt) and induced by a number of other drugs. More importantly, most patients that would receive XEN1101 or vormat are women with ~50% below 40 and potentially taking hormonal contraception. Taking hormonal contraception with XEN1101 may lead to reduced efficacy - a big concern.

So, Xene wants to submit NDA after topline X-TOLE2 expected in early 2026 (delayed from early 2025). Praxis could submit NDA after POWER1 in early 2026 (if they execute on time, we will know more after their presentation at epilepsy congress Aug 30, 2025). Issue is 250 patients in POWER1 but 260 in X-TOLE2. Praxis may need POWER2 which will finish Q4 2026 and readout likely early 2027. At worse, Praxis has a 1 year delay to market.

The Cenobamate question:

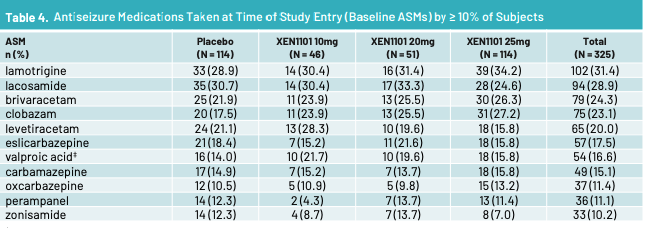

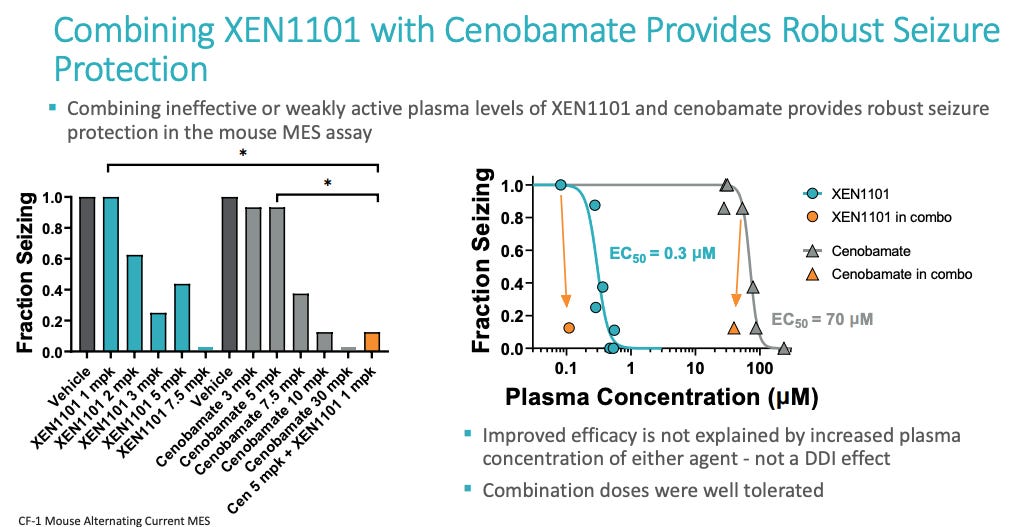

Above are the ASMs that patients on XEN1101 took per a Xenon poster. No cenobamate in XEN1101 trial. Per Aug call with Praxis management, >30% of n = 37 patients in RADIANT vormatrigine trial were on cenobamate and 55% had a >= 50% reduction in seizures from baseline. So vormatrigine works ON TOP of cenobamate. Does xenon? I’m not sure, I don’t have data on it. Cenobamate enhances GABA-A and inhibits persistent sodium current via blocking of voltage-gated Na channels. Perhaps cenobamate + Xen1101 = AEs that are too high or Xen1101 does not add much utility on top of cenobamate. We’ll see with X-TOLE2. Let’s look at mouse data from Xenon in 2021.

Cenobamate 5 mpk + XEN1101 1 mpk has a similar effect to cenobamate 10 mpk (1 mpk is roughly 5 mg for humans). There is some additivity but does that additivity get removed when actual doses are used? Is there a saturating clinical effect of this combination? 200 mg/day of cenobamate is the standard dose in humans after titration which is roughly the 30 mpk value in mice. The 30 mpk cenobamate is a near perfect eliminator of seizing in mice. So, adding XEN1101 to 30mpk won’t reveal anything useful since we’ve already squashed the problem in mice. This is a limitation of using mice models. We can cure lots of things in mice but it doesn’t translate to humans.

Praxis plans to initiate POWER3 in 1H 2026 to look at vormatrigine as monotherapy which was announced in Aug 2025 RADIANT call. It signals confidence that the management team wants to spend money to evaluate vormatrigine as monotherapy. POWER2 (n=400) with three different dose levels of vormatrigine and placebo for 12 weeks. Confirmatory trial of POWER1. POWER2 expected to complete enrollment in 2H 2026. Finally, it should be considered that patients with FOS / generalized seizures who are eligible to receive vormat or XEN1101 will need multiple treatment options. The same combination regimen will not work for everyone, and patients cycle through treatments. XEN1101 could work WITH vormat given different mechanisms of action to enhance their effect. Both could meaningfully help patients. I do not see it as a winner take all.

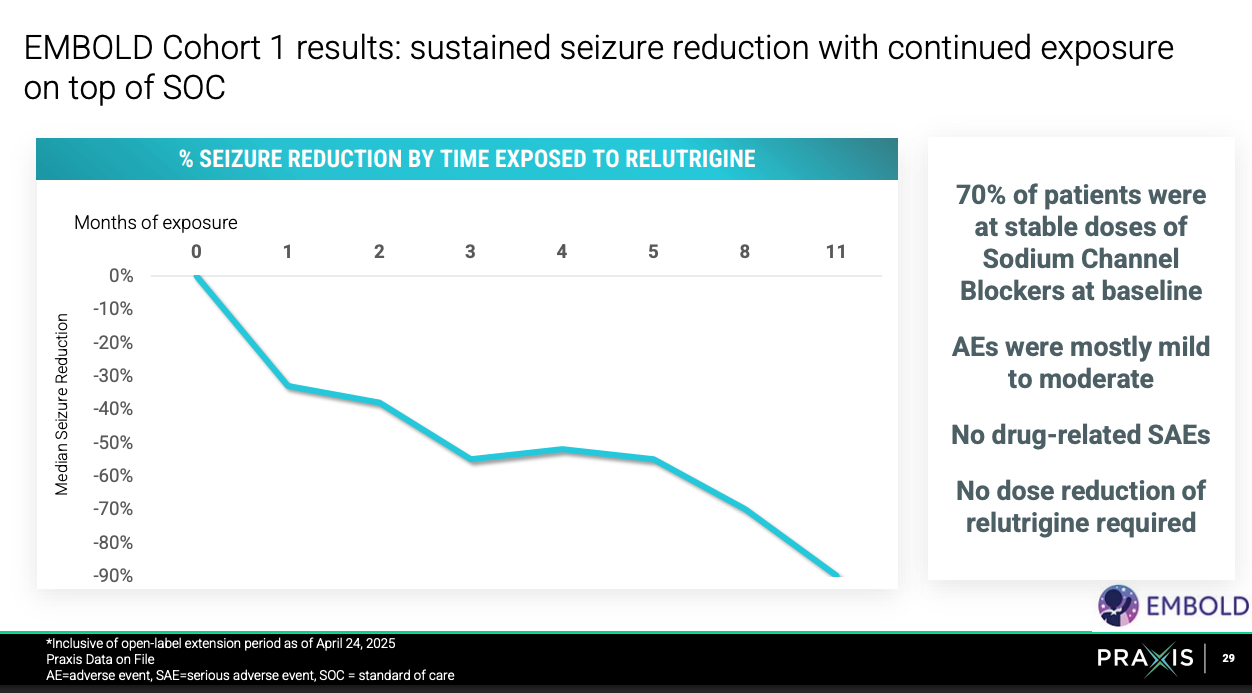

EMBOLD2 (n=80) is a continuation of EMBOLD1 (n-16) trial to confirm relutrigine’s efficacy in treating children with SCN2A GoF or SCN8A DEE. Topline results of EMBOLD2 expected 1H 2026. Study (trial design, endpoints, target patient population) is the same except larger patient size and relutrigine dose upped from 0.5 mg/kg/d to 1 mg/kg/d.

EMBOLD1 results summarized above were great. For more, see here. EMBOLD2 should be a success.

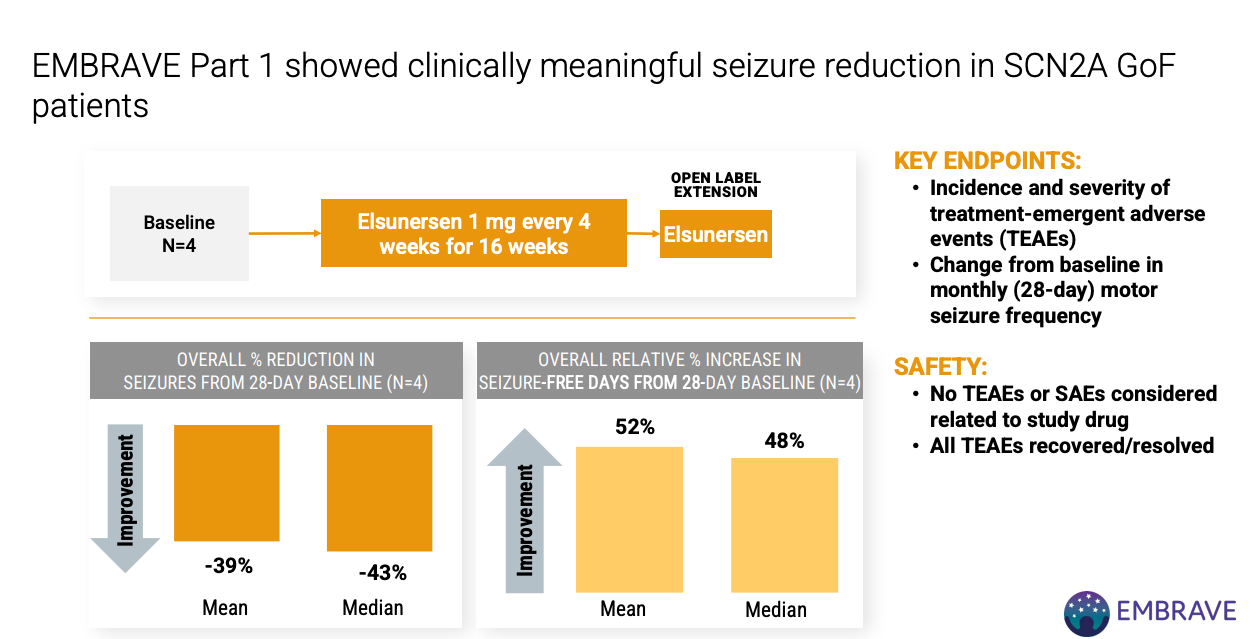

EMBRAVE Part A (Ph 1/2) n=8 of ASO elsunersen in SCN2A GoF patients. Topline results expected 1H 2026.

Relutrigine controls symptoms, but ASO can modify disease cause pathology up-front by preventing translation of some of SCN2A mRNA which normalizes ion flow and reduces seizure activity. They are complementary treatments for SNC2A GoF patients. A patient who received elsunersen under emergency circumstances went from 15+ seizures per day to 5 seizures per day (Nature Medicine).

n = 4 EMBRAVE Part 1 looks good but small sample size and kind of hard to interpret reported summary metrics.

EMBRAVE Part A has a placebo arm and topline results expected 1H 2026.

EMBRAVE3 with a similar structure (notably 1:1 randomization) has 3 cohorts that are expected to initiate mid-2025. Cohort 1 (n=40) same as Part A patient population and structure. Cohort 2 (n = 5) and 3 (n = 5) will not have a placebo and will enroll 1-2 years old and 0-1 years old patients, respectively. Cohort 1 will support Part A in registration. Cohort 2 and 3 will allow for expansion to patients at birth.

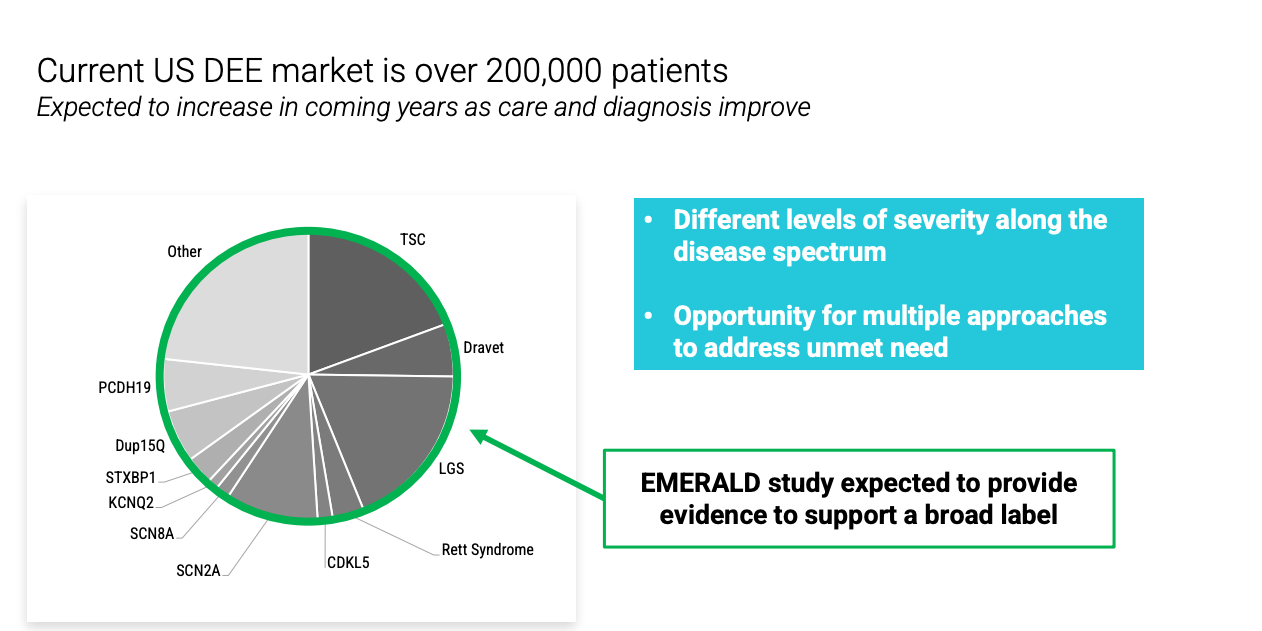

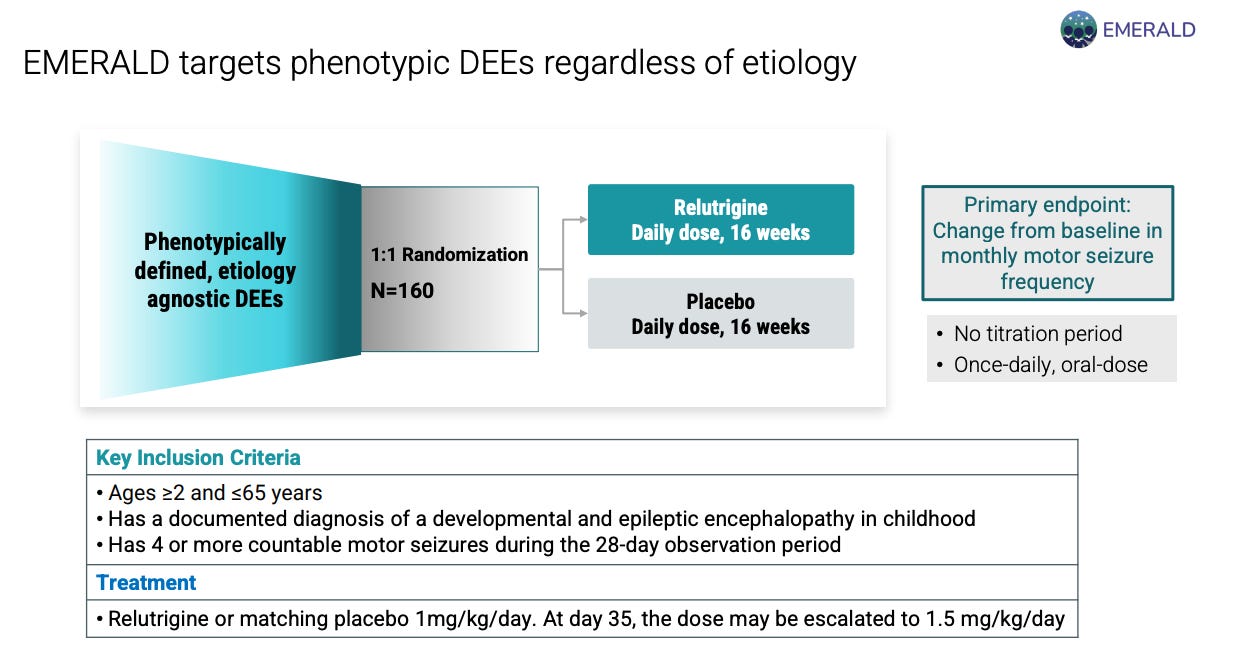

EMERALD trial investigates relutrigine in broad DEE patients (n = 160) 1:1 randomized to relutrigine or placebo. Primary endpoint is change in baseline in monthly motor seizure frequency. No titration, once daily dosing. Completion of enrollment expected in 2026.

Praxis has a number of presentations and posters at the epilepsy congress Aug 30-Sep5, 2025 on Power1 (interim results or just study design?), updates of elsunersen in emergency use, updates from Ph1 trial in vormatrigine (more safety and tolerability data to help understand AE profile better), RADIANT trial results, EMERALD (study design), EMBOLD results (possibly reporting EMBOLD2 results)

So, where does this leave us? I expect relutrigine to be approved for SCN2A and SCN8A + receive extension for broad DEE treatment. If we believe management’s slides, this is a 3B US market opportunity. I expect vormatrigine to be approved for focal onset seizures too. This is a 2.5B US market opportunity per management. It’s a little early to tell if elsunersen will work but it mechanistically makes sense and early results + case study seem to really help patients. Assign that 500M US market opportunity per management slides. Let’s assume UX is worth nothing. I have not done the math to size the markets myself but this is something to do in the future. Praxis is currently valued at 1B dollars. I see 2-3x upside from here in the next 12-18 months based on execution of POWER1, EMBOLD2, and EMERALD. Formal valuation to follow.

Cash runway to 2028 per management. 446M in cash as of June 30, 2025. They burned 26M between March 31 and June 30, 2025 (1 quarter). So that’s 4 years of runway making their end of 2028 runway a good estimate. Hedge funds have been net buyers in the last 6 quarters and insiders have not been selling.

This is a living document of my thoughts on Praxis, subject to change, and formal valuations to come too.